132 Perils of State Banking (1818)

The committee, as legislators and as guardians of the public welfare give it as their undivided opinion that banking establishments, increased as they already have been to a great extent in the interior of our state, counteract entirely all the beneficial effects expected from them. And instead of facilitating exchange and the transmission of money from one part of the state to the other, it has rendered it impossible to be done without great loss in consequence of local banks having engrossed the whole circulation in their neighborhood and the depreciation of their notes abroad, to the very great embarrassment of internal commerce. But this is not the extent of the evil nor by any means the greatest. But the effect it produces on society immediately within their vicinity is still more to be deplored.

The committee, as legislators and as guardians of the public welfare give it as their undivided opinion that banking establishments, increased as they already have been to a great extent in the interior of our state, counteract entirely all the beneficial effects expected from them. And instead of facilitating exchange and the transmission of money from one part of the state to the other, it has rendered it impossible to be done without great loss in consequence of local banks having engrossed the whole circulation in their neighborhood and the depreciation of their notes abroad, to the very great embarrassment of internal commerce. But this is not the extent of the evil nor by any means the greatest. But the effect it produces on society immediately within their vicinity is still more to be deplored.

They hold the purse strings of society and by monopolizing the whole of the circulating medium of the country, they form a precarious standard by which all the property in the country, houses, lands, debts and credits, personal and real estate of all descriptions are valued; thus rendering the whole community dependent on them and proscribing every man who dares oppose or expose their unlawful practices. And if he happens to be out of their reach so as to require no favor from them, then his friends are made the victims so that no one dares complain.

The merchant who has remittance to make abroad is contented to pocket the loss occasioned by the depreciation of their money rather than hazard their resentment by asking them for specie or current notes. And here the committee beg leave to state as a fact, an instance where the board of directors of a bank passed a resolution declaring that no man should hold a seat at that board or receive any discounts at the bank, who should trade at a certain store in the same village, in consequence of the owner having asked for a sum less than four thousand dollars in current money to remit to New York, while at the same time he kept his account in said bank.

The committee cannot refrain from remarking that hitherto liberal and extended encouragement given to banking operations beyond its legitimate object has annually invited to our capitol skillful and experienced banking agents, professing general and not local objects. Who in the present instance, from seeing notices in the state paper of eighteen new applications for banks intended to be made at the present session, have no doubt come up with high raised expectations of reaping a rich harvest. And by amalgamating banking bills with those of more importance and more salutary in their nature and by assorting and canvassing the house with all the conflicting interests of individuals until all distinction is lost between the fair and the honest petitioner and the cunning designing speculator. And thus the man who asks in the simplicity of his heart for what he honestly conceives his right is soon made to understand that in order to obtain it he must become the instrument of designing men and advocate that which his better judgment tells him is wrong. And your committee are constrained to say that this practice has hitherto been carried to such an extent and has met with such success as to encourage corporations as well as individuals to assume banking powers where none were ever granted. And after having put all law and authority to defiance and creating themselves a fund, calculating on the encouragement and skill of these agents, have had the unexampled temerity to petition the legislature of this state and urge them through the medium of these agents to grant them a charter for banking as a reward for the unwarrantable assumption of that right.

The committee will conclude this general report on the state of the currency by examining briefly the foundation on which the present circulating medium is based. The committee believe the present circulation in the state principally consists of the notes of those banks whose nominal capitals are small and composed principally of the notes of the individual stockholders, called stock-notes. So that the security of the public consists of the private fortunes of individual stockholders and those fortunes in a great measure consist of the stock of the bank for which they have given their notes. So that the bank is enriched by holding their notes and they are enriched by holding the stock of the bank. And as these banks make large dividends, many rapid and what are considered solid fortunes are made. Like a boy mounting a summit as the sun is setting suddenly observes his shadow on the opposite precipice (regardless of the gulf between) is astonished to see how tall he has grown. When night ensues, ere he is aware he is plunged, shadow, substance and all, in the abyss below, covered with darkness and despair. Such the committee extremely apprehend will be the result of many of the present institutions and bring ruin and distress on the country, unless they change their mode of business.

On the whole, the committee coincide fully in the opinion expressed by his excellency on the subject of banks in his speech delivered at the opening of the session, where he says: “The evils arising from the disordered state of our currency have been aggravated by the banking operations of individuals and the unauthorized emissions of small notes by corporations. They require the immediate and correcting interposition of the legislature. I also submit it to your serious consideration, whether the incorporation of banks in places where they are not required by the exigencies of commerce, trade or manufactures ought to be countenanced. Such institutions having but few deposits of money, must rely for their profits principally upon the circulation of their notes and they are therefore tempted to extend it beyond their faculties. These bills are diffused either in shape of loans or by appointing confidential agents to exchange them for those of other establishments. But the former mode being conducive to profit, is at first generally adopted. And in the early stages of their operations, discounts are liberally dispensed. This produces an apparent activity of business and the indications of prosperity. But it is all fictitious and deceptive, resembling the hectic heat of consuming disease, not the genial warmth of substantial health. A reaction soon takes place. These bills are in turn collected by rival institutions or passed to the banks of the great cities. And payment being required, the only resource left is to call in their debts and exact partial or total returns of their loans. The continual struggle between conflicting establishments to collect each other’s notes occasions constant apprehension. The sphere of their operations is narrowed. Every new bank contracts the area of their paper circulation and after subjecting the communities within their respective spheres of operation to the pernicious vicissitudes of loans at one period profusely granted and at another parsimoniously withheld, they finally settle down into a state of torpid inaction and become mere conduits of accommodation to a few individuals. The legislature are then solicited to apply a remedy by the incorporation of other banks, whereas every new one of this description, unless attended by peculiar circumstances, paralyzes a portion of capital and augments the general distress. The banishment of metallic money, the loss of commercial confidence, the exhibition of fictitious capital, the increase of civil prosecutions, multiplication of crimes, the injurious enhancement of prices, and the dangerous extension of credit are among the mischiefs which flow from this state of things. And it is worthy of serious inquiry whether a greater augmentation of such institutions may not in course of time produce an explosion that will demolish the whole system. The slow and periodical returns of husbandry being incompetent to the exigencies of banking establishments, the agricultural interest is the principal sufferer by these proceedings.”

If the facts stated in the foregoing be true, and your committee have no doubt they are, together with others equally reprehensible and to be dreaded. Such as that their influence too frequently, nay often already begins to assume a species of dictation altogether alarming. And unless some judicious remedy is provided by legislative wisdom, we shall soon witness attempts to control all selections to office in our counties, nay, the elections to this very legislature. Senators and members of assembly will be indebted to banks for their seats in this capitol and thus the wise ends of our civil institutions will be prostrated in the dust by corporations of their own creation. It is therefore evident, the deleterious poison has already taken deep root and requires immediate legislative interference with their utmost energy.

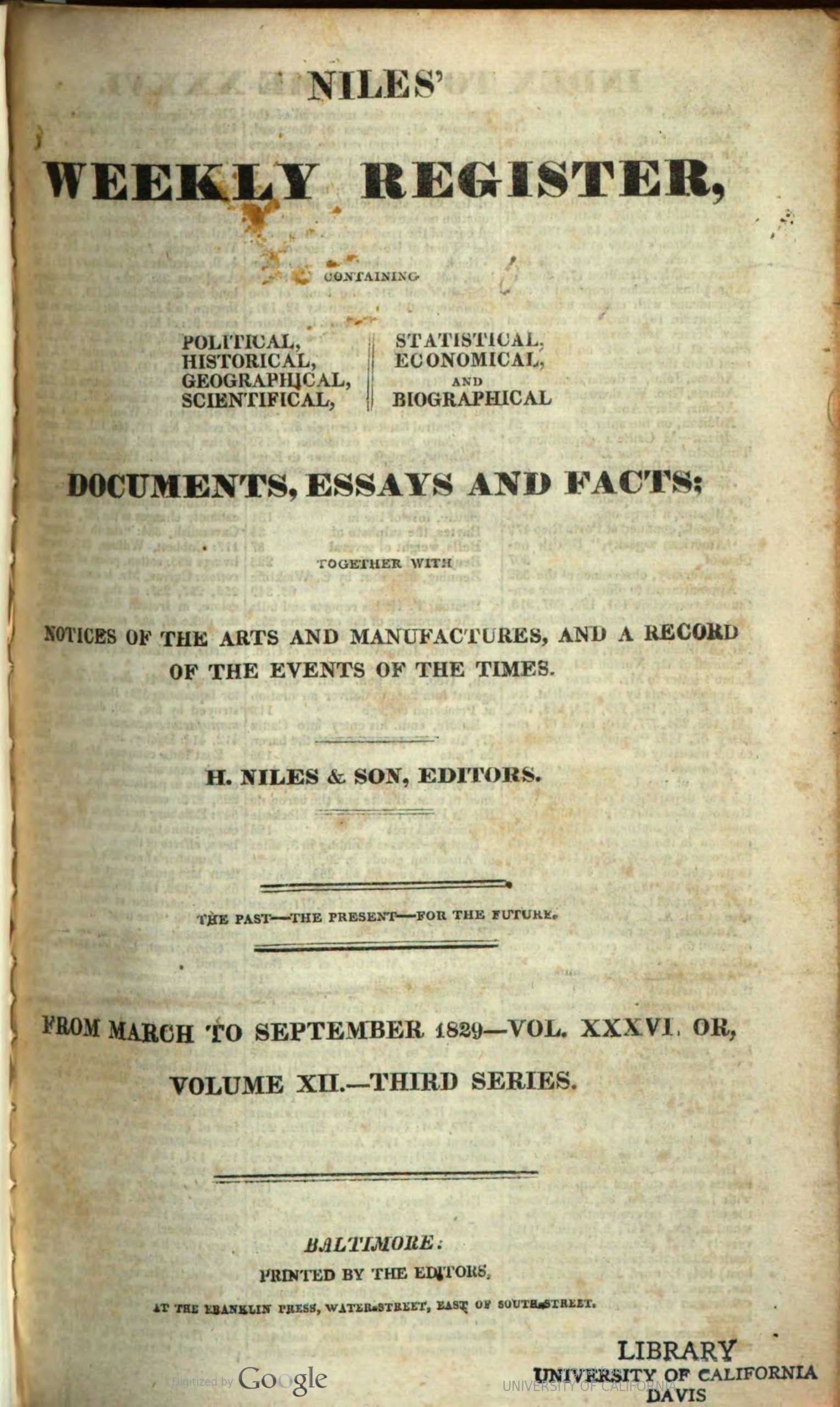

Source: Perils of State Banking (1818), by a Committee of the New York Legislature, published by Hezekiah Niles, editor, Niles’ Weekly Register, March 14, 1818, XIV, 39-41. https://archive.org/details/toldcontemporari03hartrich/page/440/mode/2up